Blog

Stories, insights & tips from Highwoods Group

The future does not get better by hope.

The future does not get better by hope.

It gets better by plan.

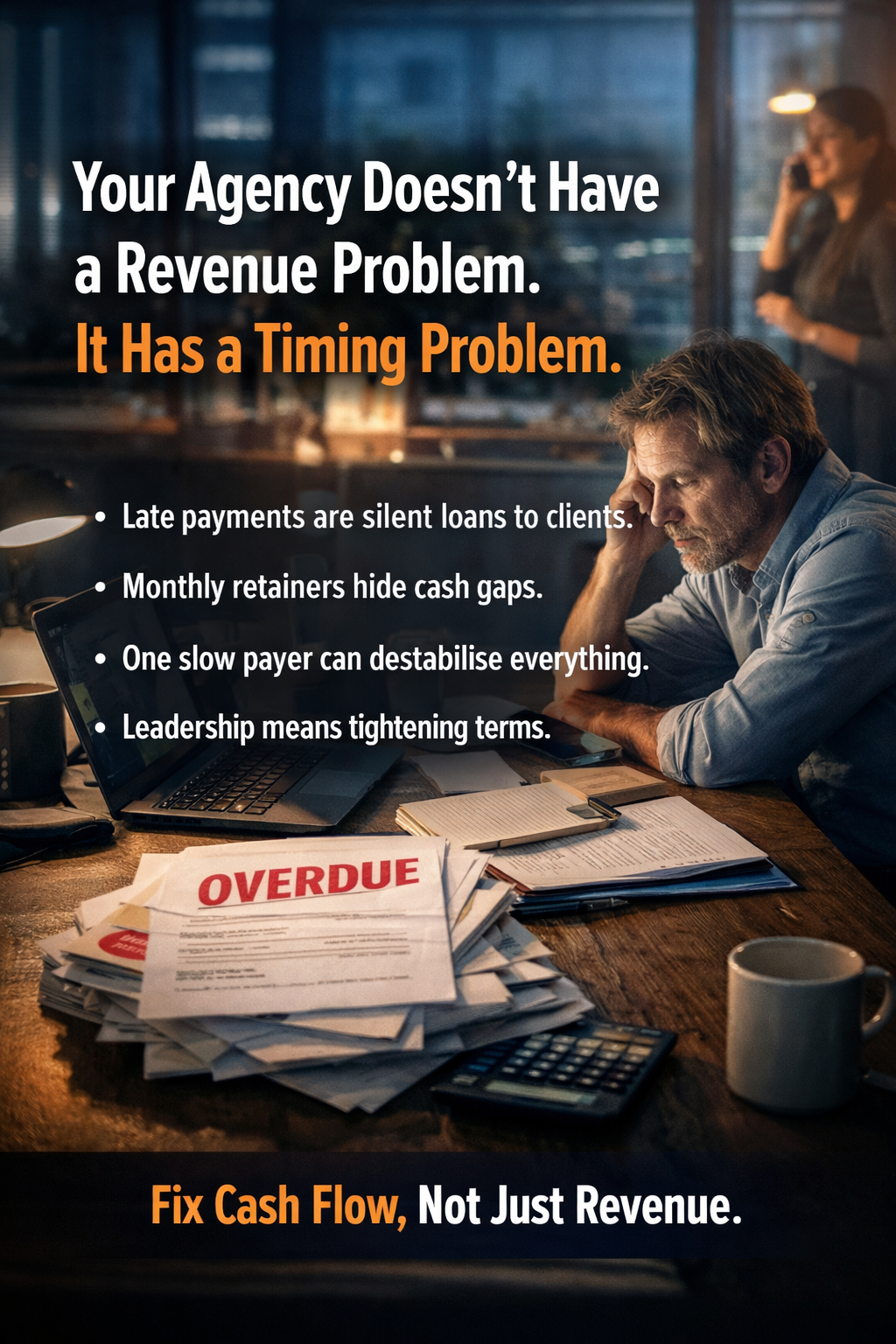

Most agencies don’t have a revenue problem.

Most agencies don’t have a revenue problem.

They have a timing problem.

The Cash Flow Test

For years, agencies chased growth as the ultimate signal of success. More clients. More revenue. Bigger teams. In 2026, that mindset is breaking businesses.

The uncomfortable truth

Agencies are brilliant at winning work, but weak at sustaining it. Not environmental soundbites. Financial and operational sustainability. Too many agencies grow revenue while margins erode, teams burn out, and decisions stay reactive.

Busy Is Not Profitable

Most agencies are busy, not profitable. They chase projects, underprice expertise, and rely on founders to hold everything together. That model does not scale and it will break under rising costs, tax pressure, and client expectations.

Preparing for 2026

Here is the brutal truth. Most businesses do not fail because of a lack of ideas. They fail because they enter a new year carrying last year’s noise, inefficiencies, and half decisions.

Strengthening Your Agency This Christmas

As Christmas approaches, most agencies slow down externally but this is not the time to switch off internally. The firms that grow sustainably use December to strengthen foundations while others simply wait for January.

Is Your Agency’s Growth Sustainable?

Many agencies talk about growth, but very few grow in a way that protects margins, team health and long-term stability. Growth looks good on the surface, yet underneath many agencies are running on thin profit, inconsistent delivery and unpredictable cash flow.

Smarter Director Pay

If you run a limited company, how you pay yourself is one of the biggest financial decisions you’ll make next year.

The new tax year brings a key shift for UK limited company directors. Dividend tax is rising, which means your usual salary, dividend split will cost more even if your income stays the same. The structure still works, but the margin is tighter. Getting the numbers right matters.

6 Mistakes That Stop Businesses Scaling

Growing a business is not the same as scaling one. Many SMEs generate more revenue each year yet never gain stability, control or momentum. The reason is simple. Growth exposes weaknesses. And most businesses repeat the same avoidable mistakes that slow them down.

Your Path to Strategic Growth

Every growing business moves through predictable stages. The challenge is not spotting the stages, but recognising when your leadership needs to evolve. The path shown in the graphic reflects a simple truth. Growth is not a straight line. It is shaped by the decisions you make at each point in your journey.

The Hidden Cost of Chasing ‘Success’

Most agencies mistake activity for progress. They sprint from campaign to campaign, chasing short-term wins and shiny new opportunities, yet their profit graph looks like a heart monitor, up and down without control.

Keeping Pace with Change

The landscape for UK businesses is shifting fast. The UK Finance “Supporting SMEs in the Transition to Net Zero” report (October 2025) revealed that more than 70% of small businesses still lack the systems and skills to measure or report their environmental impact. For accountants and advisors, this represents both a challenge and an opportunity.

Companies House identity verification becomes mandatory soon.

From 18 November 2025, all UK company directors and persons with significant control (PSCs) must verify their identity with Companies House. This reform is part of the government’s crackdown on economic crime and aims to create a more transparent, trustworthy business environment.

The Sustainable AI Advantage for UK SMEs

The biggest mistake I see in UK SMEs is treating automation as an IT project rather than a strategic reform. AI and cloud finance are not just about speed; they are about accuracy, transparency, and sustainability.

The Fast-Growth Journey

Setting up and scaling a tech or SaaS business is an exciting journey — but it also comes with complex financial and strategic challenges. At Highwoods Group, we specialise in guiding entrepreneurs through every step of the fast-growth journey.

R&D Tax Relief for Innovative Businesses

We are committed to supporting businesses in maximising their financial efficiency through expert tax and accounting services. As part of our continuous effort to enhance value for our clients, we are pleased to introduce our R&D Tax Relief application service.

Limited Company Directors Responsibilities

The cost of living crisis is a very real concern for many individuals and businesses in the UK. With prices rising and wages stagnant, it's becoming increasingly difficult to make ends meet. As accountants in Shoreditch, we've seen first-hand the impact this crisis is having on our clients. That's why we want to help you understand how much money you need to survive during these challenging times.

Managing Your Finances During the Cost of Living Crisis

The cost of living crisis is a very real concern for many individuals and businesses in the UK. With prices rising and wages stagnant, it's becoming increasingly difficult to make ends meet. As accountants in Shoreditch, we've seen first-hand the impact this crisis is having on our clients. That's why we want to help you understand how much money you need to survive during these challenging times.

The Power of the Numbers

In today’s competitive business environment, every decision you make has the potential to impact your bottom line. Whether you’re a small business owner, a start-up founder, or the director of an established company, financial data is your most valuable asset for making informed decisions. It provides a clear picture of how your business is performing, helping you identify strengths, weaknesses, and areas of untapped potential.